PATENTVEST PULSE

The Next Era of Surgical Robotics

Who’s Leading, What They Own, and Why IP Will Decide Who Gets Bought

July 10, 2025

A data-driven breakdown of the $188B market opportunity, 28 emerging platforms, and the patent strategies shaping who wins and who exits.

Surgical robots are used in less than 6% of eligible procedures. The reason isn’t clinical. It’s strategic. High costs, complex workflows, and rigid system design have slowed adoption. But that’s changing fast.

This PatentVest Pulse report maps the transformation of a category once defined by a single system (da Vinci) into a fragmented and fast-moving race for defensibility. With over 18,000 patent families, $4B in M&A, and 28 companies profiled, we reveal who’s building platforms that scale and who is likely to be acquired next.

Key Insights

- This Isn’t About the Next da Vinci. The real shift is toward smaller, modular, and specialty-aligned platforms built for outpatient settings, not mega systems for flagship hospitals.

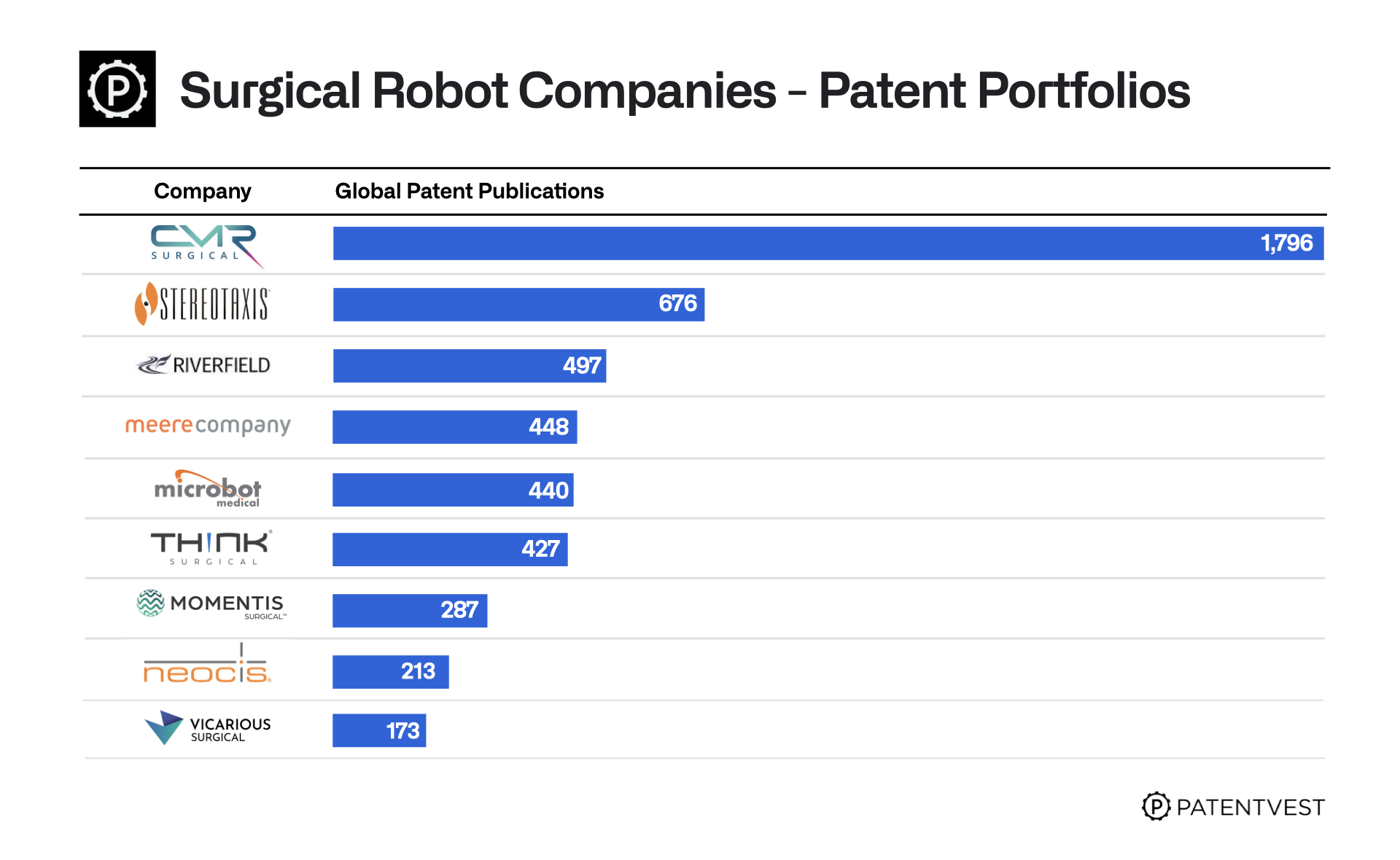

- CMR Surgical Is Quietly Overtaking Intuitive. With 1,796 patents and FDA clearance, CMR now outpaces Intuitive in IP filings over the past decade. The torch is already being passed.

- 28 Companies Are Redefining the Field. From endovascular to ENT to gynecology, this isn’t a hype cycle. It’s a cohort of focused, capital-backed platforms built for specific use cases, not flagship hospitals.

- IP Is the Real Competitive Map. Our review of 18,000+ patent families reveals who owns the foundation, where white space remains, and why defensibility, not just funding, will decide who gets bought.